Fiscal Policies in Kenya: Effects on Poverty and Inequalities by Agence Française de Développement - Issuu

3. How does inequality shape the demand for redistribution? | Does Inequality Matter? : How People Perceive Economic Disparities and Social Mobility | OECD iLibrary

3. How does inequality shape the demand for redistribution? | Does Inequality Matter? : How People Perceive Economic Disparities and Social Mobility | OECD iLibrary

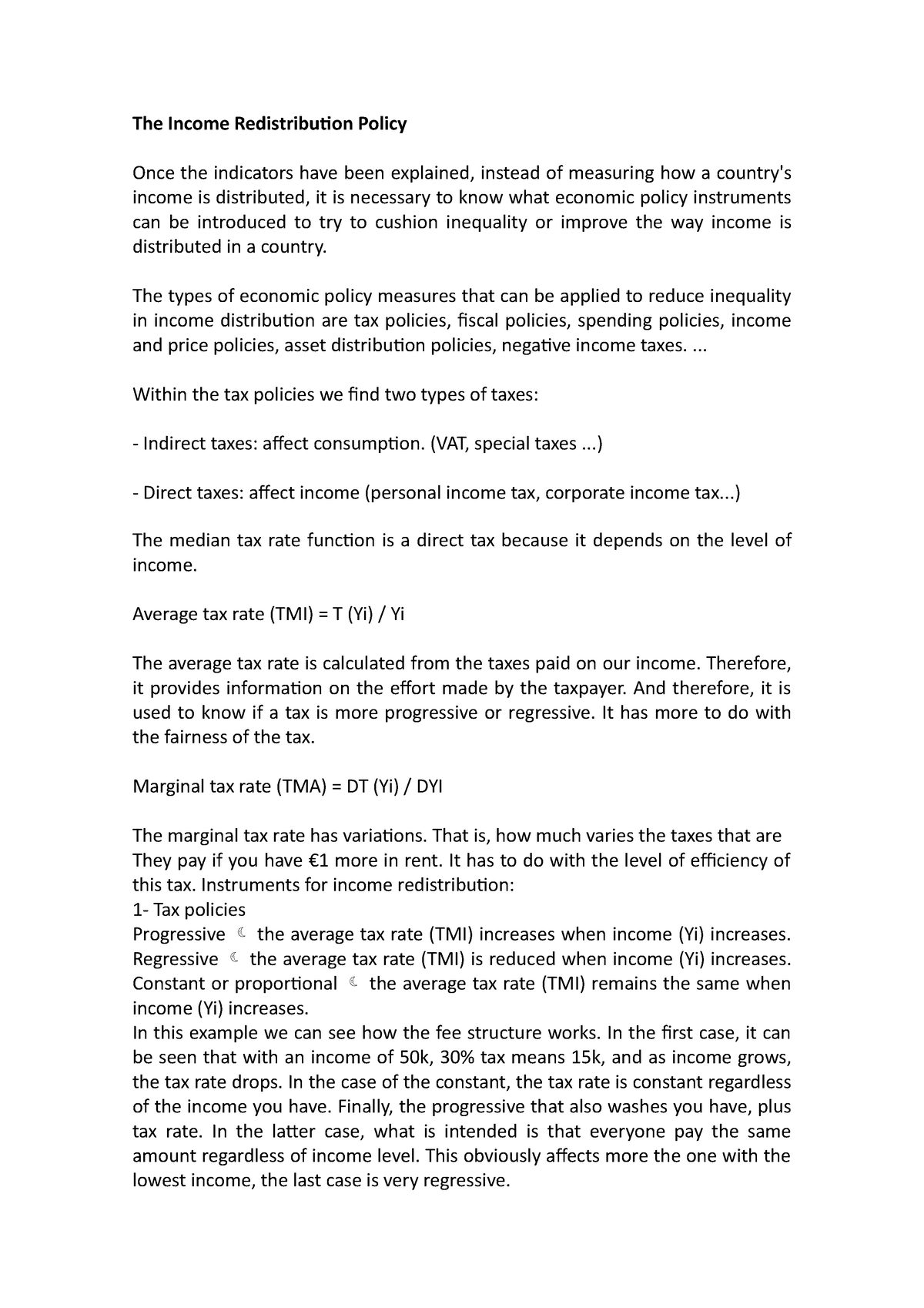

The Income Redistribution Policy - The types of economic policy measures that can be applied to - StuDocu

3. How does inequality shape the demand for redistribution? | Does Inequality Matter? : How People Perceive Economic Disparities and Social Mobility | OECD iLibrary

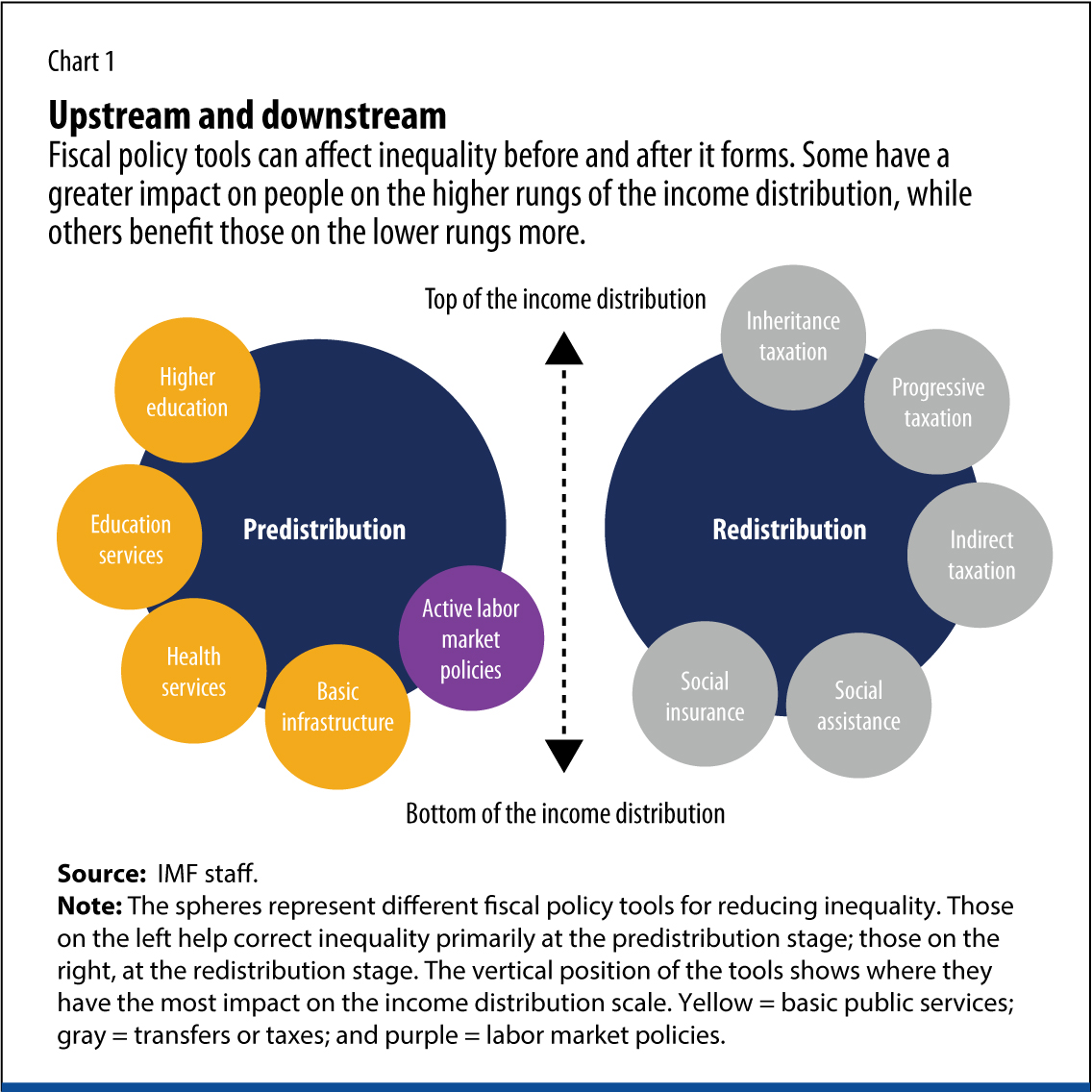

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

![Revisiting the Debate on Inequality and Economic Development [1] | Cairn.info Revisiting the Debate on Inequality and Economic Development [1] | Cairn.info](https://www.cairn.info/vign_rev/REDP/REDP_255.jpg)